Q&A: How Risk Mitigation Finance Can Cut CSP Costs

2019.09.17 From: SolarPACES

ACWA Power and Shanghai Electric sign an EPC agreement for a large scale CSP project for DEWA in the UAE

Cutting risk in financing will be the next key to further cut CSP costs, according to the author of Non-recourse project financing for concentrated solar thermal power

published in the journal Utilities Policy. Dr. Steven Geroe teaches

Energy and Environmental Law and Contract Law at Melbourne's La Trobe

Law School, and became interested in China's renewable energy finance

and investment while working for a Chinese investment law firm involved

in clean energy projects.

I noticed some of the CSP research papers you cited are written in Chinese characters. Do you read Chinese?

SG:

Yes, I lived in China and studied Chinese for about 20 years. I

interviewed Chinese energy related institutions because one of my

interests in the Chinese regulatory approach is how the Chinese are

utilizing special expertise in drafting renewable energy-related

regulation for consulting in the drafting process.

So my

researching is partly in Chinese and my Chinese research assistants – my

grad students help me in my understanding. I only practiced law briefly

a long time ago: I'm more interested in research and writing on

contracting law, energy and environmental law and international

investment.

One of the aspects that I am interested in is the

evolution of Chinese debt markets and forms of contracting and doing

business. So what it appears at the moment as the Chinese go global

strategy which has got several aspects most prominent now is probably

the silk Road the one belt one road project.

As they go global,

strategic investments in developing countries around the world are

giving Chinese businesses and financiers a lot of experience in

international forms of contracting and doing business, so I think that

is likely to be a driver in increasing integration of those kinds of

contracting. For example in non recourse financing on a domestic basis.

And

I think the evolution of the Chinese capital markets domestically is

likely to support that as well and also a long-term trend of the

reduction of foreign reserves as the proportion of GDP down from about

50% to about 28% now. it's probably driving an increasing openness to

international investors for large-scale domestic projects as well.

Why is de-risking finance important now for CSP growth?

SG:

Quite a lot of stars are aligning for CSP. It has already seen

dramatically falling technology costs due to the learning curve and mass

production, and then the recent spurt of large-scale deployment in

emerging countries like Morocco and China. There is a confluence of

factors so that a technology that has shown a lot of potential over the

years but never really had its time in the sun maybe having its time in

the sun now.

I think that there is now real potential emerging of

contractual and de-risking strategies and technology maturity making

CSP a viable investment carrier for institutional investors, as there’s a

number of risks specific to CSP, according to the EU report (link to

name) which did extensive surveys of a whole range of all the commercial

stakeholders.

Policy stability was the biggest risk they cited.

Technology risk was also key and so having performance guarantees was

contractually better for suppliers and technology providers in the EPC

contract. And revenue predictability, from having an adequate PPA, like

in the 35 year DEWA contract, is important in a non-recourse loan.

Your

paper notes that non-recourse financing increased from 16% in 2004, to

52% by 2015. Why does this kind of financing lower CSP costs?

SG:

Non-recourse loans are very good at spreading and allocating risks. You

have got a lot of big players on both sides; on the financing side,

typically syndicates of big international banks who are able to allocate

risks across a number of large institutions and on the investment side,

a consortium of investors who will also be pretty large-scale.

And

then through the web of contracting risk you are spreading risk to all

the contractors. And the contractors can be pretty large-scale as well

in terms of the EPC contracting for the building of the plant and the

operation and maintenance contracts in the PPA.

A specific

purpose vehicle – or SPV, is the central aspect of non-recourse

financing. The sponsors or investors set up a separate company as a

project company which holds the assets, so what that means is the

financiers can only sell off the assets of the project, but they don’t

have recourse to the investors themselves who Invested in the project

company.

International banks will do their due diligence and have

extensive security agreements covering the collateral of the SPV and

they may also have some direct contractual arrangements with the other

contractors. They have to do their due diligence that the project has

got enough in guaranteed cash flow so that they will get their money

back from the cash flow of the project.

To have a bankable

project – CSP or otherwise – you have to have very good risk allocation

management contractually and also a good backup in terms of de-risking

strategy.

So non-recourse financing is a fairly complex structure

with fairly high transaction fees but it has proven effective in

mobilizing very large-scale investments for high risk projects because

of its risk allocation capacity.

Where else has non-recourse finance been used?

SG:

Initially it was used in the oil and gas industry in the United States,

when there were fairly large investments in sort of hit-or-miss

projects. Non-recourse historically has been for larger scale – higher

risk projects so it is considered a useful structure four high risk

projects which have got good revenue generation potential.

So its

been a very common form of financing infrastructure in the energy

sector but it is being used in other large infrastructure construction

projects and more generally in a large range of areas; ports, hospitals,

roads, airports. A PPP structure – a public-private partnership

structure – quite often has a non-recourse aspect as well.

In

your paper you identified complementary debt guarantees as a good

pairing with non-recourse loans, noting its success in bringing down

costs in offshore wind financing. Which countries have tried debt

guarantees?

SG: Debt guarantees were pretty prominent in

American solar generally where the Obama administration stepped up in

response to the debt crisis. There was also a debt guarantee in one of

the largest CSP plants in the world, the MASEN contract for the 580 MW

Noor CSP plant in Morocco, and in that case the debt guarantee was to

cover the difference in prices between coal and CSP.

{The details are in the paper:

“The

170 MW Phase 1 of the project utilised a BOOT structure between the

Moroccan Agency for Solar Energy – MASEN, and ACWA Power Ouarzazate, a

special purpose vehicle incorporated under Moroccan law. ACWA is under a

turnkey contract to design, finance, construct, operate, and maintain

the power station. Its experience in solar investments in the Middle

East and Africa was also seen to limit the risk involved with MASEN’s

relative lack of experience in complex projects as the primary

off-taker. The debt financing of the project included a €200m

traditional loan by the African Development Bank (“AfDB”) to MASEN, plus

a €165m concessional loan by the African Development Bank Clean

Technology Fund (“CTF”) to MASEN.

Both loan amounts will be on lent by

MASEN to ACWA Power, which has primary responsibility to repay AfDB. The

first or intermediary off-taker is MASEN. As the intermediary

off-taker, MASEN re-sells the power generated to the Office National de

l’Electricité et de l’Eau Potable (“ONEE”), Morocco’s sole electricity

distribution utility. The first PPA between ACWA and MASEN is

twenty-five years based on production costs, at US$ cents 18.9 per kWh.

The second PPA, also for twenty-five years, applies to the on-selling by

MASEN to ONEE, and is based on the net rates applicable in Morocco. As

net rates applicable in Morocco (for coal-fired power) were expected to

be lower than (CSP) production costs, this created a revenue risk for

the project vehicle ACWA. This risk was addressed by a guarantee over

both loans by the Kingdom of Morocco to the extent of the

diferential

between the two PPA rates.”

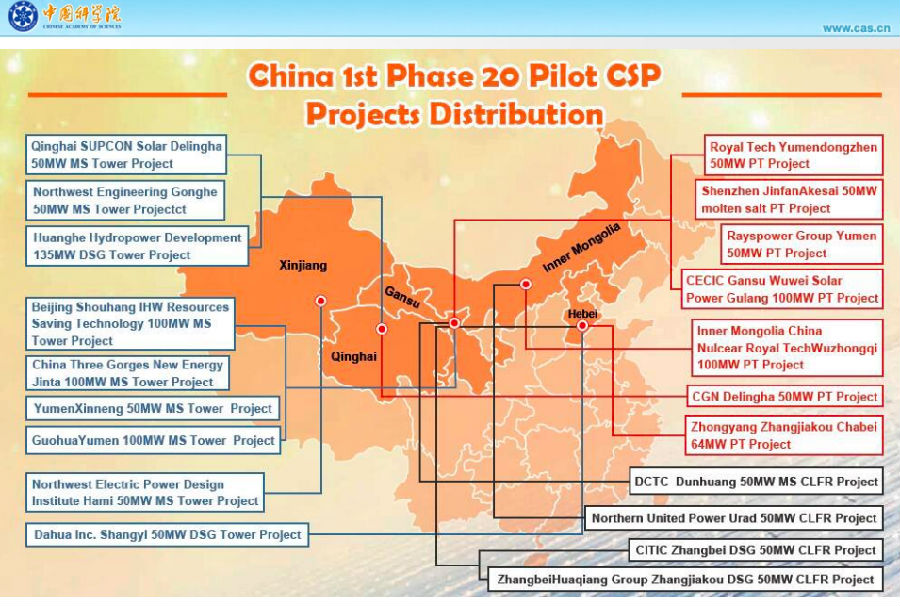

China’s pilot CSP projects 2016-2020 IMAGE@CSP Focus

Policy stability is the other de-risking factor; I guess that is China's advantage?

SG:

Yes, the central government in China has had long-term targets which it

has taken seriously. That's really been the official position since I

think since the 2007 Chinese National Climate Change Plan when the

central government clearly recognized both the future and existing

impacts of climate change..

Environmental concerns are very

different in China because it is a key area of public concern as it has

direct health consequences, more with particulate pollution of water and

air, but that feeds through to the governments approach to

environmental issues. The Chinese are genuinely committed to reducing

emissions and to doing so with the most efficient technology in a

cost-effective manner.

The whole political dynamic around

renewable energy is very different from countries like North America and

Australia where we have had powerful incumbent fossil fuel industries

with fairly substantial political clout that makes them resistant to

change. Although there are both private sector and state-related fossil

fuel interests in China too, such interests are less intractable in

China, particularly at the central government level. So I don't think

there are any comparable political obstacles from the fossil fuel

industry.

However, there's clearly also a downside in terms of

central planning and overall coordination. They have serious

coordination difficulties. I think a pretty common example of that is

the trailing grid connection for wind turbines: they structured their

wind subsidies for construction rather than production. So there are

policy shortcomings.

Generally what happens in China across a lot of

industries anywhere from automotive to solar power is there tends to be

generous government subsidies and programs which create a rush into

industries and there is a kind of a stampede into industry followed by a

a very rapid shakeout so it's a lot of pain for a lot of companies and

that happened in solar PV.

Do

you expect the Chinese government will do anything to avoid winding up

with just one or two giant CSP firms left standing as weaker players are

weeded out?

SG: I think they'll genuinely allow or try to

facilitate direct competition between rival technologies and choose the

best. They are taking an experimental and empirical approach: using

their learning from these experimental projects and making decisions

down the line.

Market liberalization is their official state policy

driven through the central planning process, so more competition between

market-based entities, and breaking up entities and encouraging

competition. However that is a fairly stalled process, so there does

tend to be a lot of market domination by the big players.

Upcoming CSP events:

3rd CSP Focus Innovation 2019(Oct.24-25, Beijing China)

10th CSP Focus China 2020 (March, Beijing China)

More CSP news and reports please visit www.cspfocus.cn

or CSP Focus social media on LinkedIn, Twitter, Facebook.

More from CSP Focus

NextOn-site views on Morocco NOOR Ouarzazate 510MW Solar CSP Complex

ChumillasTechnology, in the largest Concentrated Solar Power plant in Latin America

DEWA opens R&D centre at Dubai concentrated solar power plant

DEWA launches tender for 900MW 5th phase of Mohammed bin Rashid Al Maktoum Solar Park

Technology to address climate change is Earth's biggest opportunity

Solargis illustrates solar resource assessment for China CSP projects

Leave your thoughts here

Reports(Member Only)

See more+-

CSP Focus Membership Proposals

We are now proposing CSP Focus Membership, hoping to better serve our members to keep pace with the latest updates of ongoing CSP projects worldwide, and to establish and maintain business relations with major shareholders of the projects. CSP Focus offers to Membership exclusive access to:1. Daily/Weekly update and analysis on CSP policies, projects, technologies, market trend and corporate relea

-

The Latest CSP Focus Monthly Update

Join CSP Focus Membership to Get the Latest CSP Focus Monthly Update December Edition.

-

CSP Project Monthly Update 2022 December Edition

CSP Focus is presenting CSP Project (China) Update 2022 December Edition.Detail report is available for CSP Focus Membership.

-

Presentations-CSP Focus China 2021

The Report is for CSP Focus Members only.

Upcoming Events

See more+-

12th CSP Focus China 2022

2022.04.21-22 Beijing

-

11th CSP Focus China 2021

2021.10.28-29 Beijing

-

10th CSP Focus China 2020

2020.10.22-23 Beijing, China

Project Updates

See more+-

Lanzhou Dacheng Dunhuang CSP Project

Asia Pacific-China,Operational,Parabolic Trough

-

Luneng Haixi 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower

-

Dubai 950MW NOOR Energy 1 CSP+PV Project

MENA-UAE,Under construction,Power Tower

-

Power China Gonghe 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower