Single digit CSP tariff with “Made in China”?

2017.09.12 From: CSP Focus

CSP Focus China Tour 2017 (Nov.5-14)

deep visit to China CSP projects and leading value chain companies

The recent CSP biddings in Dubai and Australia refreshed the record-low price for solar CSP projects. Dubai 200MW tower CSP project received the lowest bidding from ACWA consortium with USD 9.45 cents/kWh, and SolarReserve won the bid of 150MW CSP tower project in South Australia with the price of USD 6 cents/kWh.

Both of the CSP projects manifest a clear decline trend on CSP tariff, which is much faster than previous estimation from IEA and IRENA. And as the Chinese companies become more active in international CSP markets, the cost of the CSP project is supposed to be further declined, especially the cost of EPC and component supplies.

China launched the program of 1st round of 20 pilot CSP projects with the total capacity of 1.349GW earlier last September, making China one of the most promising CSP markets for global CSP players. By the end of 2020, China is planning to allocate 5 GW CSP plants, almost the double of the current world CSP capacity.

“It has been obvious for a long time that the demand for CSP was low because the costs were high, and the costs were high because demand was low. Something was needed to pull CSP out of this trap, by scaling up its use,” as Jonathan Walters, independent energy economist and former World Bank regional director in the MENA region says, “Scaling-up” is a great way to boost the cost reduction of CSP and brings it to single digit age and even go further.

What’s more, the local value chain for China concentrating solar power (CSP) industry has been getting mature through the fast development of the past decade. The local companies are able to produce almost all the key equipment and materials including receivers, molten salt, heliostats, concentrators, mechanical & hydraulic drives, control equipment for DCS, and glass reflecting mirrors. Statistics show that solar field key components like receiver tubes and reflecting mirrors could reach 1-2 GW capacity to equip the CSP plants (without TES) till 2016.

However, considering the situation that China is still at a relatively early age for CSP industry, there are several areas where the local developers and contractors, in order to ensure the success of the first round of pilot projects, would like to find cooperation with overseas experienced companies with CSP references. As surveyed by CSP Focus, the areas include:

● Project development: Feasibility Study; DNI analyst; Innovative project financing; Bid document and RFP preparation;

● EPC: Basic & Detail engineering in the solar field and HTF&TES system; EPC management; Procurement & Manufacturing inspection; On-site construction supervision; Acceptance test and Commissioning; CSP simulation system

● O&M: Mirror cleaning; Cloud forecast; Smart control system; Self-consumption and backup fuel usage optimization

● Key component: Tower receiver; Molten salt pump and valves; SGS generation system; Heat tracing and isolation; Swivel joint; tracker system

In the upcoming CSP Focus China Tour on Nov 5-14, you will have the chances to meet with the projects developers and contractors, and visit the projects under construction, so that you may have a better understanding on the cooperation opportunities with the potential clients in China. And visitings to manufacturing plants of receiver tubes, reflector mirrors, and other key components are also included during this tour, offering opportunities to witness the manufacturing capacity, quality control mechanism, testing facilities, and logistic packaging etc.

More from CSP Focus

NextHORA expects valve service for China concentrated solar power plants

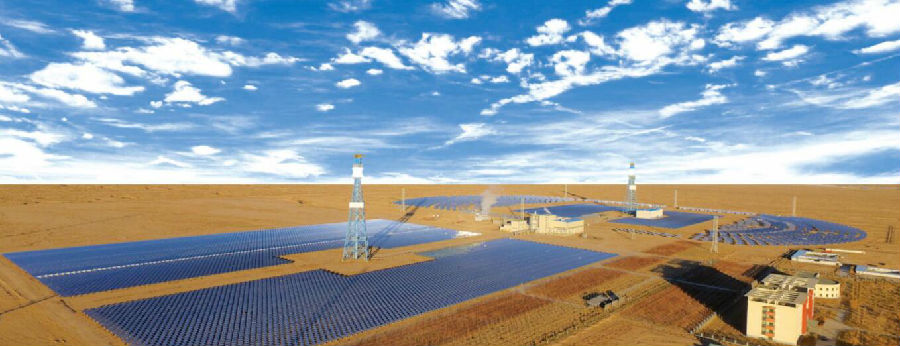

Site visit to China Shouhang Dunhuang 10+100MW CSP tower project

CSP capex costs fall by almost half as developers shift towards China and Middle East

China pilot CSP project--Supcon Solar Delingha 50MW CSP plant

CSP capex costs fall by almost half as developers shift towards China and Middle East

Leave your thoughts here

Reports(Member Only)

See more+-

CSP Focus Membership Proposals

We are now proposing CSP Focus Membership, hoping to better serve our members to keep pace with the latest updates of ongoing CSP projects worldwide, and to establish and maintain business relations with major shareholders of the projects. CSP Focus offers to Membership exclusive access to:1. Daily/Weekly update and analysis on CSP policies, projects, technologies, market trend and corporate relea

-

The Latest CSP Focus Monthly Update

Join CSP Focus Membership to Get the Latest CSP Focus Monthly Update December Edition.

-

CSP Project Monthly Update 2022 December Edition

CSP Focus is presenting CSP Project (China) Update 2022 December Edition.Detail report is available for CSP Focus Membership.

-

Presentations-CSP Focus China 2021

The Report is for CSP Focus Members only.

Upcoming Events

See more+-

12th CSP Focus China 2022

2022.04.21-22 Beijing

-

11th CSP Focus China 2021

2021.10.28-29 Beijing

-

10th CSP Focus China 2020

2020.10.22-23 Beijing, China

Project Updates

See more+-

Lanzhou Dacheng Dunhuang CSP Project

Asia Pacific-China,Operational,Parabolic Trough

-

Luneng Haixi 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower

-

Dubai 950MW NOOR Energy 1 CSP+PV Project

MENA-UAE,Under construction,Power Tower

-

Power China Gonghe 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower