Home > Market > Other Regions > Here

Chile builds Concentrated Solar Power plant through COVID-19

2020.04.30 From: HELIOSCSP

The Cerro Dominador project has overcome COVID-19 restrictions and is now 90% complete but the longer term impact on industry raises offtaker risks.

Despite COVID-19 restrictions, construction of the 110 MW Cerro Dominador CSP tower plant in Chile is advancing to the final stages.

Developer Cerro Dominador is seeking more power customers and plans further CSP plants in Chile but COVID-19 has clouded growth outlooks. (Image credit: Cerro Dominador)

Located in the Atacama Desert, the Cerro Dominador plant is Latin America’s first Concentrated Solar Power plant and features a record 17.5 hours of molten salt thermal energy storage capacity. Owned by EIG Global Energy Partners, the plant will be combined with an operational 100 MW PV plant to supply power 24 hours a day.

To limit the impact of COVID-19, the Cerro Dominador team has implemented strict hygiene and self-distancing protocols to ensure construction can continue.

There are currently over 900 people working across the large site and the project is over 90% complete, Fernando Gonzalez, CEO of Cerro Dominador, told New Energy Update.

Last month, EPC partners Abengoa and Acciona installed the receiver at Cerro Dominador. Weighing 2,300 tons, the receiver was installed at a height of 220 meters and will receive solar energy from 10,600 heliostats. Salt melting for the storage system was completed this month, another key step ahead of commercial start-up.

“Our next steps include the finalization of the piping in the tower and the receiver and the beginning of the commissioning of the plant using hot molten salt,” Gonzalez said.

After controlling the short-term risks, Cerro Dominador must now overcome the wider economic effects of COVID-19.

Chile’s industrial sectors are keen to reduce carbon emissions but the ensuing economic crisis from COVID-19 has increased the challenge of securing long-term offtake contracts.

Months away

In response to the pandemic, Chile closed its borders to international travellers on March 18. Thus far, domestic travel restrictions are concentrated around the capital Santiago and there is a nationwide curfew from 10pm to 5am local time.

As yet, there have been no significant delays to equipment and component supplies for Cerro Dominador due to COVID-19 restrictions, Gonzalez said.

Commercial start-up of the plant has been postponed by a few months to replace electrical equipment following a fire at the top of the receiver last November, Gonzalez noted.

The plant is now expected to start commercial operations in the second half of 2020, rather than in May as previously planned, he said. The PV plant will be used to fulfil offtake contracts until the CSP plant is completed.

New customers

The Cerro Dominador plant has been a long time coming. Back in 2014, the Chilean government awarded the project a 15-year power purchase agreement (PPA) at a price of $114/MWh. In 2016, the project suffered a two-year stoppage when original co-owner Abengoa underwent financial restructuring.

Since 2014, global CSP costs have fallen dramatically and spurred interest from energy-intensive companies, including Chile’s large mining community.

Last December, Cerro Dominador secured a five-year power purchase agreement (PPA) with Chilean fuel distributor Copec. The new PPA was scheduled to start in July 2020 and supply 50% of Copec’s energy needs, reducing its annual CO2 emissions by 19,850 tons. The contract will cover 72 Copec service stations, almost all of Copec’s electricity charging stations and eight of its 16 industrial plants in Chile.

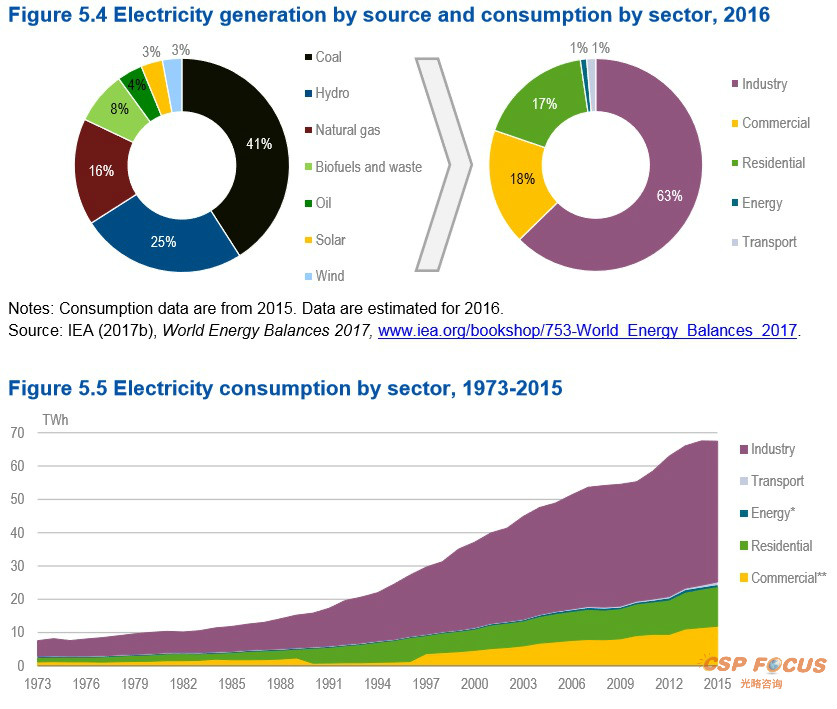

Chile power generation, consumption

Source: International Energy Agency’s Chile energy policy report, 2018

The Cerro Dominador company is now actively working to sign further PPAs for the plant, a task made harder by COVID-19.

Prior to the outbreak, Chile’s total power demand was forecast to rise by around 25% by 2030 but COVID-19 has sliced global demand outlooks and raised counterparty risks. It also increases uncertainty for future CSP projects.

Demand curbed

Across the world, stay-at-home orders have sliced power demand. In Chile, energy-intensive industries such as mining are already adapting to logistical constraints and the longer term economic impact of COVID-19.

The Chilean Chamber of Construction (CChC) forecasts investment in construction projects could fall 10.5% this year, following the COVID-19 outbreak and widespread social unrest in Chile in Q4 2019, sparked by a rising cost of living.

In February, Chile’s national energy commission postponed a key power generation auction from June until November, citing lower-than-expected demand forecasts.

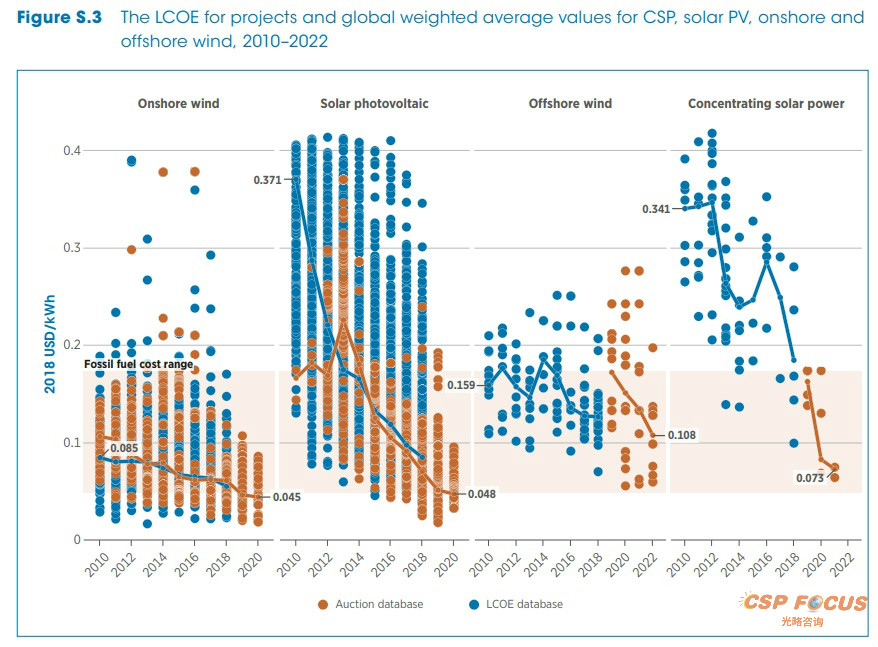

The auction will pitch CSP developers against conventional power plants. Cerro Dominador plans to bid its 450 MW Likana CSP tower project in the tender and predicts a new world record CSP price, beating the previous low of $71/MWh set in Morocco last year.

“This is a very competitive market where you can win or lose a contract by a few cents,” Gonzalez warned.

Global costs for solar, wind in 2010-2022

Source: International Renewable Energy Agency report,’Renewable power generation costs in 2018′ (May 2019).

Power investments

Chile must maintain regulatory and social stability throughout the COVID-19 crisis to pursue major spending plans on power plant infrastructure, Maria Trinidad Castro, executive director at the World Energy Council Chile, told BNAmericas in March.

“If the situation can be contained relatively quickly, power sector investments are likely to remain mostly unaffected, as they are capital intensive and aim for long-term returns,” Castro said.

Crucially, Chile’s government has pledged to increase the share of renewable energy from 20% in 2018 to 60% by 2035. Installed power capacity was 23.3 GW at the end of 2018. Chile will close 1.1 GW of its 5 GW coal-fired fleet by 2024 and shut down the remaining capacity by 2040.

Going forward, growth in low-cost PV and wind capacity will increase the value of storage capacity offered by CSP plants. Chile is also expected to introduce new regulation that supports storage investments.

How this regulation values each technology and provides long-term market stability will prove «critical,» Gonzalez said.

By Kerry Chamberlain

Upcoming CSP events:

10th CSP Focus China 2020 (June 18-19, Beijing China)

5th CSP Focus MENA 2020(September 9-10,Dubai, UAE)

More CSP news and reports please visit www.cspfocus.cn

or CSP Focus social media on LinkedIn, Twitter, Facebook.

More from CSP Focus

NextCloud camera system WobaS provides solar power plants with reliable radiation nowcasts

CSP capex costs fall by almost half as developers shift towards China and Middle East

Longer contracts leverage the free fuel in solar power at little O&M cost

COMBO-CFB Project Develops Innovative Concept to Increase Solar Energy Production

Pictures丨CSP Focus MENA delegation visiting 100MW Shams 1 parabolic trough CSP plant

Leave your thoughts here

Reports(Member Only)

See more+-

CSP Focus Membership Proposals

We are now proposing CSP Focus Membership, hoping to better serve our members to keep pace with the latest updates of ongoing CSP projects worldwide, and to establish and maintain business relations with major shareholders of the projects. CSP Focus offers to Membership exclusive access to:1. Daily/Weekly update and analysis on CSP policies, projects, technologies, market trend and corporate relea

-

The Latest CSP Focus Monthly Update

Join CSP Focus Membership to Get the Latest CSP Focus Monthly Update December Edition.

-

CSP Project Monthly Update 2022 December Edition

CSP Focus is presenting CSP Project (China) Update 2022 December Edition.Detail report is available for CSP Focus Membership.

-

Presentations-CSP Focus China 2021

The Report is for CSP Focus Members only.

Upcoming Events

See more+-

12th CSP Focus China 2022

2022.04.21-22 Beijing

-

11th CSP Focus China 2021

2021.10.28-29 Beijing

-

10th CSP Focus China 2020

2020.10.22-23 Beijing, China

Project Updates

See more+-

Lanzhou Dacheng Dunhuang CSP Project

Asia Pacific-China,Operational,Parabolic Trough

-

Luneng Haixi 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower

-

Dubai 950MW NOOR Energy 1 CSP+PV Project

MENA-UAE,Under construction,Power Tower

-

Power China Gonghe 50MW Molten Salt Tower CSP Project

Asia Pacific-China,Operational,Power Tower